What is a TWIA policy? A TWIA policy, linked to the right, is a contract between the policyholder and TWIA. The policy provides wind and hail coverage when insurance companies exclude it from homeowners and other property policies sold to coastal residents.

What does a TWIA policy cover? TWIA policies provide coverage only for windstorm and hail damages to property covered by the policy. By law, no other perils (such as fire or theft) are covered by TWIA policies. TWIA policies do not cover flood damage. Flood coverage can be obtained through the National Flood Insurance Program (NFIP).

How much does a TWIA policy cost? There are several factors that affect your premium (how much you pay for a policy). The deductible is chosen by a policyholder and has the biggest impact on how much premium a policyholder pays. The average residential policy premium is approximately $1,700 per year.

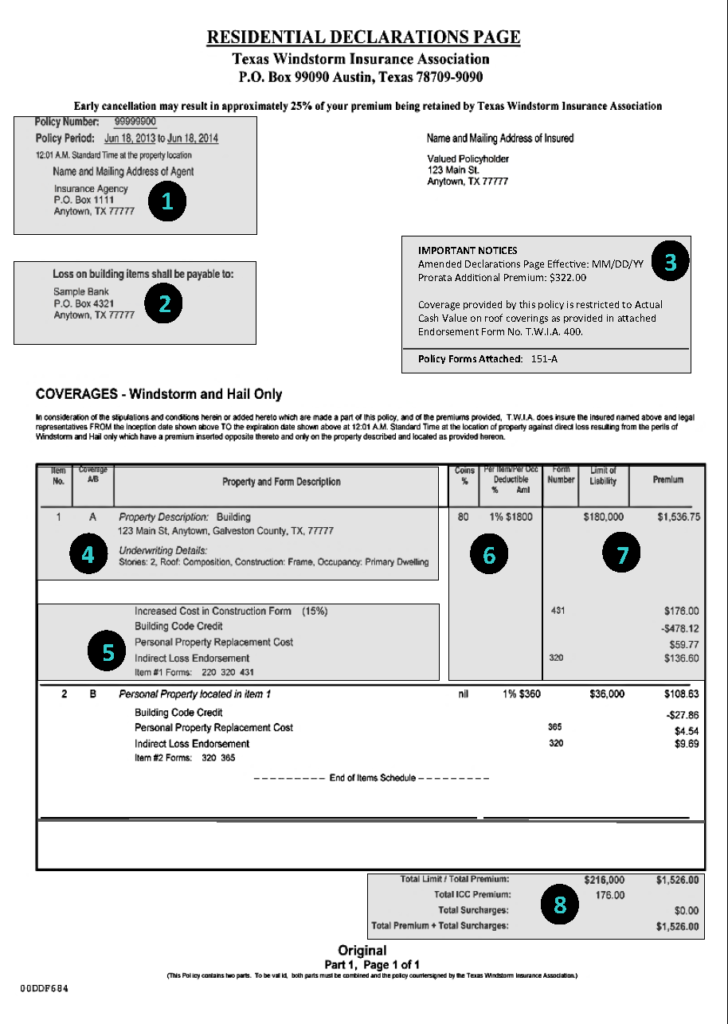

How do I know what my policy deductible is? The policy declarations page, sample linked to the right below the policy, is at the front of every TWIA policy. It customizes the policy to the policyholder’s specific coverage needs and shows the deductible (in #6 below), as well as other important information.

The following identify the corresponding sections in the sample declarations page linked to the right below the policy.

1. Your policy number, coverage period and agent

2. Mortgage company or other third party who may receive payment in the event of a loss

3. Messages and any customized coverage forms attached to your policy

4. Coverage A/B: A indicates coverage on a structure and B indicates personal property

- Property Description covers the property type and location

- Underwriting Details: indicates details of the construction and/or occupancy of the property

5. Policy coverages, forms, credits and surcharges

6. Coinsurance Requirement: the amount of coverage you must carry in relation to your home’s value. There are two kinds of home value:

- Cash Value is the replacement value minus depreciation

- Replacement Value is the amount it would cost to replace your home (not the market value)

Your agent should help you determine the amount of coverage needed to meet your coinsurance requirements

- Per Item/Per Occ Deductible: the deductible that applies to each item listed on the declaration page per loss

7. Form Number: form reference numbers on policy

- Limit of Liability: amount of insurance for the policy

- Premium: amount you pay, including credits and/or surcharges

8. Total limit of liability, premium, and surcharges for the policy

For an explanation of these terms, visit our Insurance A to Z page.